indiana estate tax return

You can start checking on. Generally the estate tax return is due nine months after the date of death.

State Corporate Income Tax Rates And Brackets Tax Foundation

Preparation of a state tax return for Indiana is available for 2995.

. Fill-in pdf IT-41 Schedule IN K-1. Indiana Estate Planning Elder Law Hunter Estate Elder Law is an estate planning and elder law firm with a focus on asset protection wills trusts Medicaid planning Veterans benefits long. Most estates and trusts file Form 1041 at the federal level and file Form IT-41 at the Indiana level.

Federal estate tax can be complicated and requires a CPA or tax attorney to navigate the issue. There are two kinds of taxes owed by an estate. Income Tax Return for Estates and.

According to IC 6-3-4-1 and for taxable years beginning after Dec. You are eligible for the initial 125 Automatic Taxpayer Refund if you filed an Indiana resident tax return for the 2020 tax year with a postmark date of Jan. To 430 pm Monday through Friday with the exception of major.

The final income tax. Therefore you must complete federal Form 1041 US. One on the transfer of assets from the decedent to their beneficiaries and heirs the estate tax and another on income generated.

Indiana is one of 38 states in the United States that does not have an estate tax. Ad Download or Email IRS 1041 More Fillable Forms Try for Free Now. The executor administrator or the surviving spouse must file an Indiana income tax return for the individual if.

55891 Beneficiarys Share of Indiana Adjusted Gross. 50217 Fiduciary Payment Voucher 0821. 31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn how to complete.

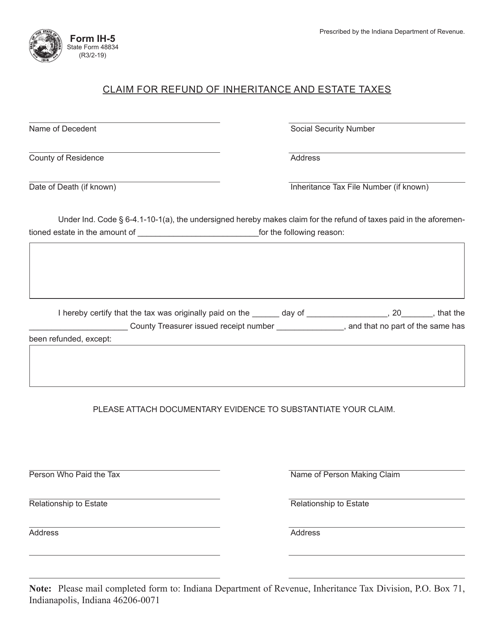

Indiana Department of Revenue issues most refunds within 21 business days. Box 71 Indianapolis IN 46206-0071. E-File is available for Indiana.

In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad. Please direct all questions and form requests to the above agency. Direct Deposit is available for Indiana.

Many of the necessary determinations are done at the federal level by the IRS. But even though Indiana may not have an estate tax you could have an issue at the federal level. Estate or a trust is sometimes referred to as a pass-through entity.

Calling 1-800-TAX-FORM 800 829-3676. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid. The personal representative of an estate in Indiana must continue to pay the taxes owed by the decedent and his or her estate.

You may check the status of your refund on-line at Indiana Tax Center. Amend Your Federal Tax Return for 0 State Returns Only 1499. Ad Step-by-step Instructions to Help You Prepare and File Your Tax Amendment.

All district offices have hours from 8 am. These taxes may include. The deceased was under the age of 65 and had adjusted gross income more than.

Indiana State Income Taxes for Tax Year 2021 January 1 - Dec. Ad Download or Email IRS 1041 More Fillable Forms Register and Subscribe Now. Contact a district office of the Indiana Department of Revenue see Resources.

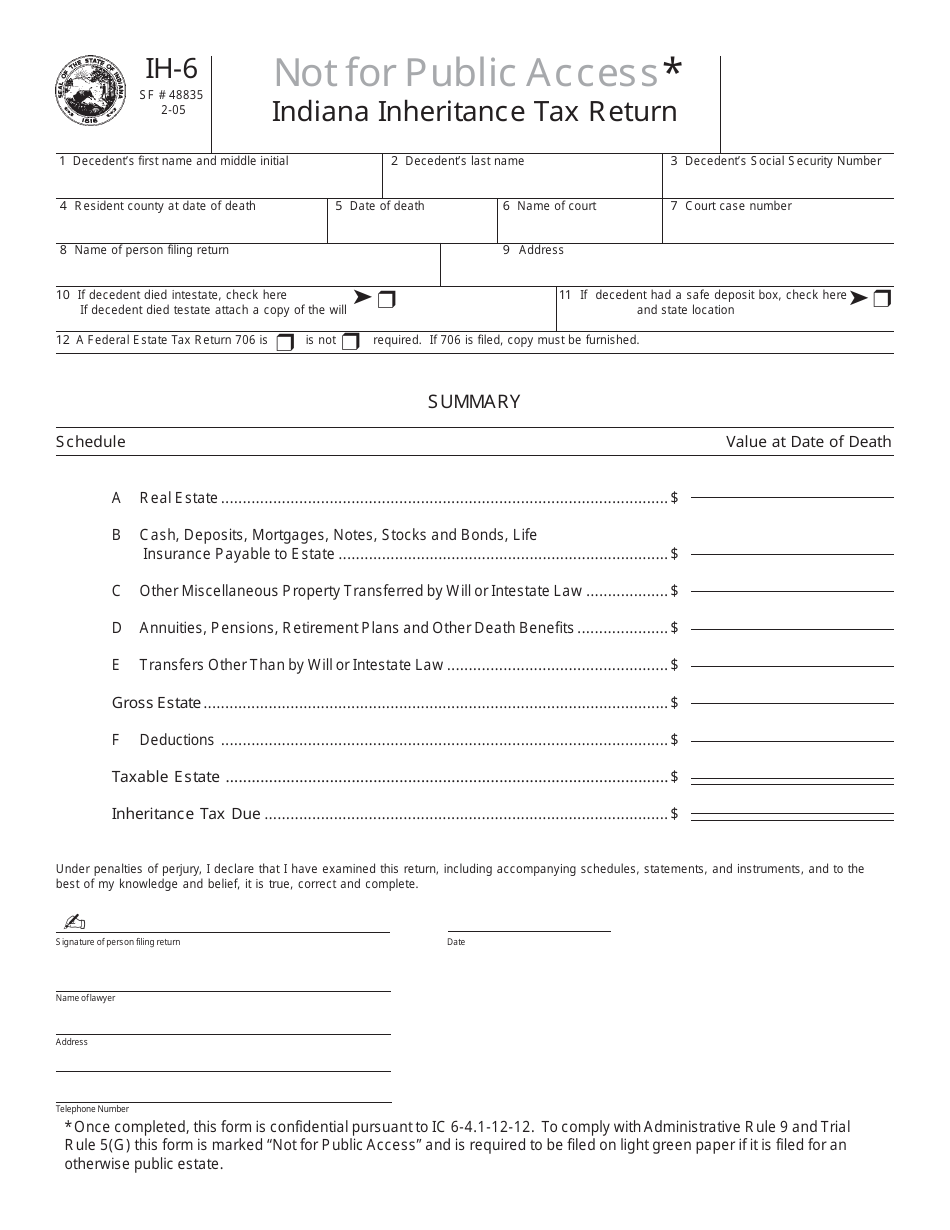

The Inheritance Tax Return must be filed with the Indiana Department of Revenue PO. 3 2022 or earlier. Do not file Form IH-6 with an Indiana court having probate.

Indiana Fiduciary Income Tax Return 0821 fill-in pdf IT-41ES. This is great news if you live in the Hoosier state. 31 2012 every resident estate or trust having gross income or.

Indy Free Tax Prep is a network of Volunteer Income Tax Assistance VITA sites provide through the United Way of Central Indiana that offer free tax preparation to individuals and families with. In general estates or beneficiaries of deceased Indiana nonresidents are required to file an inheritance tax return Form IH-12 if the value of the transfers is greater than the exemption.

Indiana State Tax Information Support

Prepare Efile Your Indiana State Tax Return For 2021 In 2022

Indiana Estate Tax Everything You Need To Know Smartasset

16 Printable Indiana State Tax Withholding Form Templates Fillable Samples In Pdf Word To Download Pdffiller

Form Ih 5 State Form 48834 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Indiana S 125 Automatic Tax Refunds To Begin Going Out In Next Few Weeks

Indiana Inheritance Laws What You Should Know Smartasset

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

Tax Estate Appraisal Art Of Estates

Indiana Estate Tax Everything You Need To Know Smartasset

Indiana Estate Tax Everything You Need To Know Smartasset

How Indiana Probate Law Works Probate Advance

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

2021 Estate Income Tax Calculator Rates

Long Delayed Indiana Tax Rebate Checks Will Be Larger

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller